A small island economy the size of Tennessee, Cuba finds itself in the crossroads of world history and the global economy. In recent years, Cuba has suffered from the painful external shocks of exorbitant energy costs and rising food prices. And the island has been laid siege to by its formerly dominant and geographically proximate economic partner, the United States, which has imposed punishing, comprehensive economic sanctions—including prohibitions against investments—unprecedented in their scope and longevity.

The sudden withdrawal of Soviet subsidies in the early 1990s precipitated a major crisis but only a partial, hesitant course correction while Cuba’s Latin American neighbors made major strides forward through structural reforms and deepening engagement with the global economy. Only through such integration into the global economy can Cuba hope to modernize its factories and farms, realize economies of scale, and gain access to large markets, new technologies, and investment capital.

Tough and resilient, the Cuban economy survives and evolves—and is today opening another reform chapter, one that seems likely to be more consequential than earlier turns of the wheel. This time around, Cuba can build on its impressive investments in human capital, its quality health care, and universal education, originally undertaken by the revolution largely for humanitarian reasons. Today’s high-quality workforce is a potent building block in the race toward higher earned incomes and more lucrative integration into global markets.

Assessing foreign investment in Cuba is complicated by the scarcity of data. The Cuban government’s culture of secrecy takes on extreme form when it addresses international capital flows. Spectacularly, Cuba simply does not publish a capital account! Cuba releases no numbers on capital inflows or outflows, nor is there an official accounting of foreign reserves. And offerings within the current account that record capital-related flows are presented in highly aggregate form: There is but one line for renta (income), which includes transactions (both outgoing and incoming) on interest, dividends, and profits, “among others.”1

When pressed for an explanation, the Cuban government points to U.S. hostility, affirming that the U.S. Treasury might take advantage of greater transparency to harass Cuba’s economic partners or seize Cuban assets. These fears may well be justified, demonstrating yet another example of how U.S. sanctions engender precisely the behavior pattern—in this case, extraordinary state secrecy—that the United States decries. In spaces where Cuba apparently feels less threatened, such as social indicators, or even the direction and composition of merchandise trade, statistics are made more readily available.

For more “normal” nations, international organizations are a good source of information on foreign investment flows. But not so in the case of Cuba, since the governments that are the primary sources of information on foreign direct investment (FDI) flows chose not to release most Cuba-related data, either because they do not have the information or or because they deferred to confidentiality concerns. Those numbers that are released woefully understate flows and are discounted by knowledgeable Cuban economists. For example, the United Nations Conference on Trade and Development (UNCTAD) estimates for Cuba an accumulated foreign investment stock of just $215 million for the years 1990 to 2009, $97 million of which are attributed to the period from 2007 to 2009.2 The World Bank publishes almost identical numbers, showing $210 million in FDI net inflows during 1994 to 2009 (and $85 million in 2010).3 In tension with these numbers, the International Monetary Fund’s Coordinated Direct Investment Survey indicates that Spain alone reported direct investments in Cuba of $583 million (end-2010).4 But these reported numbers clash with the magnitude of foreign investment activities that are readily visible on the island and recorded in the annual reports of international firms engaged in Cuba.

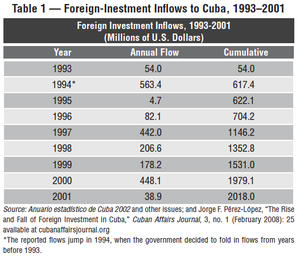

During the brief period from 1993 to 2001, the Cuban government did publish some limited, highly aggregated data on foreign investment flows. Cumulatively, reported flows through 2001 totaled $2 billion (Table 1).

This useful series was discontinued after 2001, when another emerging option caught Cuba’s attention: the availability of state-owned capital in countries, notably Venezuela and China, that offered certain advantages from the Cuban perspective. These friendly powers were prepared to offer capital on subsidized terms and in ideologically comfortable state-to-state deals.5 For these transactions, notoriously non-transparent and often not reported to the international agencies that track FDI, it is extremely difficult to estimate actual investment flows; to disentangle announcements, commitments, and on-the-ground implementation; and to decipher whether the deal is structured in the form of equity (wholly owned or joint ventures), an arms-length service contract, or as a production-sharing agreement (as is often the case in the petroleum sector). The capital flows may not qualify as FDI at all, but rather as state banking loans. This has been the case with the Brazilian involvement in the Mariel port expansion and in the renovation of a sugar refinery in Cienfuegos province—projects often erroneously labeled in the media as “investments.”

Perhaps the best-informed estimate of the stock of Cuba FDI comes from an international financial consultant (who wished to remain anonymous) with privileged access to foreign-investment data. The source noted that according to the Cuban central bank, FDI inflows as of 2001 totaled $1.9 billion (very close to the published figure of $2.02 billion; see Table 1) and estimated that by 2009 the total stock may have reached $3.5 billion. He added another telling estimate: 20 investors accounted for nearly $3 billion of the $3.5 billion.

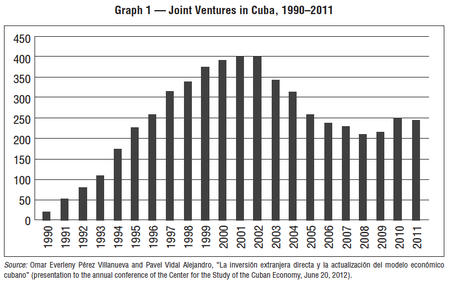

The remaining universe of some 200 joint ventures (Graph 1, page 15), therefore, would account for only about $500 million in investment capital, or an average of $2.5 million per project.

Cuban economists working on FDI have made use of data not on dollar volume of FDI flows but rather on the number of joint-venture projects, broken down by economic sector and country of origin. These project numbers are generally sourced to unpublished government documents and occasionally to reports in the official Cuban media. The aggregate numbers do not indicate the capital value or strategic importance of the projects and lump together significant investments with very small ventures, including tiny brokerage firms. Nor do they make clear whether the investments are merely indications of intentions or whether capital has actually been transferred. They also lump together the top 20 joint ventures that account for the lion’s share of capital with those 200 small- to micro-ventures. Even so, the aggregate numbers are extraordinarily small As of 2011, the total number of joint projects stood at 245 (Graph 1). These included 67 hotel administration contracts, eight production and service administration contracts, and 13 production cooperation agreements.

Moreover, not all of these joint projects included private partners; some hail from Venezuela as the source country and presumably many of these projects engage not private investors but rather Venezuelan state-owned enterprises.6 Compare the number of joint ventures operating in Cuba with the number of foreign affiliates reported to be operating in other countries of roughly comparable size and development: 911 in Chile; 754 in Croatia; 5,387 in Ireland; 2,761 in Malaysia; 5,144 in Portugal; and 2,049 in Taiwan.7

The number of joint projects in Cuba has been in sharp decline since 2002, when they peaked at just over 400, then fell by half by 2008. This consolidation occurred for several reasons. The Cuban state closed down many joint ventures, having concluded that they were either not living up to their original promises, were not advancing Cuban economic goals, were losing money, or were behaving illegally.8 Some firms withdrew upon finding it impossible to carry on a successful business within the context of Cuban state planning; firms entering during the heady reform years of the mid-1990s were taken aback when Fidel Castro decided to halt and even roll back some of those hopeful market-oriented measures. In some cases, Cuban state-owned enterprises did not welcome competition from private firms that had certain advantages, such as superior access to foreign credit and therefore to imported inputs, and so used their access to government agencies to squeeze the joint ventures; hapless joint projects reported that their electricity rates or real estate rents suddenly spiked, gasoline was no longer delivered on time, visas were denied to international experts, access to critical foreign exchange was blocked, etc. Students of the political economy of state planning would not be surprised to hear of state-owned enterprises leveraging their political networks to disable private competitors.

In 1998, the Cuban government announced as a matter of principle that it preferred large-scale joint ventures to smaller ones.9 Apparently, this preference remains in place. Yet this bigger-is-better prejudice flies against contemporary trends in international economic thought that argue the opposite: that small and medium-size firms (SMEs) are often more innovative and flexible, and employ more workers per dollar invested than very large firms. Nor is it necessarily an either/or proposition, as larger firms can benefit from being surrounded by efficient, specialized smaller suppliers.

The Cuban government’s opposition to smaller ventures seems particularly odd at a time when it seeks to stimulate employment, increase the availability of consumer goods, and actively promote small scale enterprise.

Citing internal government documents, Cuban sociologist Mayra Espina Prieto estimated that joint ventures employed 0.7% of the state’s 4.9 million-person workforce—about 34,000 people.10 This rather small number seems plausible, considering that some of the larger joint ventures are located either in capital-intense mining and energy (Sherritt International) or in international marketing (Habanos, Pernod Ricard), an industry whose sales forces are primarily located overseas and that does not directly employ the producers of tobacco or rum. Nor does this estimate take into account the large numbers of workers in hotels that are owned by Cuban state enterprises but managed by foreign firms under administration contracts.

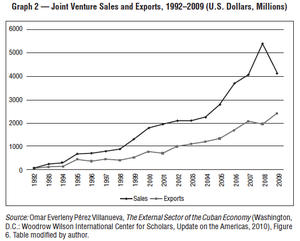

Some joint ventures are strategically placed in the vital export sector. According to Cuban economist Omar Everleny Pérez Villanueva (based upon his access to unpublished data), joint ventures accounted for $1.9 billion in exports of goods and services in 2008. He attributed 80% of these exports to just a handful of firms.11

Pérez Villanueva places these businesses in nickel, tobacco, citrus fruits, beverages, tourism, and communications, among others. Based upon our case studies and the high degree of industrial concentration, it is possible to place names on these firms: Sherritt International (nickel), Habanos (British Imperial Tobacco, cigars), Havana Club rum (beverages), Rio Zaza, BM (both citrus fruits), and Sol Meliá (tourism). Further relying on unpublished government statistics, Pérez Villanueva presents data indicating that total joint venture sales in the period from 2007 to 2009 averaged $4.5 billion, including both exports and domestic sales (Graph 2). At $4.5 billion in sales, joint ventures would account for roughly 7% of Cuba’s total production of goods and services, reported at $62 billion (2009).13

Law 77 (Chapter IV, Article 10) allows for FDI in all sectors except health, education, and “the armed forces institutions, with the exception of the latter’s commercial system.” In practice, joint ventures have also been largely excluded from two sectors where foreign investors could make a huge contribution: sugar and biotechnology. In the case of sugar production, the obstacles appear to be rooted in revolutionary history. The expropriations of the large, often foreign-owned estates were a hallmark of the revolution; to return the land to foreign hands might seem an inglorious retreat. There is also the unresolved question of compensation to the former owners, necessary to free the lands from potential legal challenges by claimants and U.S. sanctions.

Today, as officials reconsider FDI within the context of economic reforms, there is a sharp debate over whether and to what degree to further open food processing and agro-industry, including sugar-based biomass, to external capital. In an apparent victory for more favorable treatment for FDI, in late 2012 and after lengthy negotiations, the Cuban government approved a joint venture, Biopower, S.A., with British investors, to generate biomass from sugar derivatives; the roughly $50 million investment is to construct a 30-megawatt power plant. Billed as a pilot project, the British firm, Havana Power, hopes that other biomass energy projects will follow.13

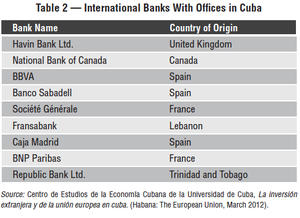

In the case of biotechnology, government officials voice fears that foreign partners will take advantage of Cuban firms and pirate their innovations. Rather than turn to the European and Japanese multinational pharmaceutical giants to assist in marketing Cuban innovations and pharmaceutical products, Cuba has preferred to seek state-to-state commercial deals with developing countries (notably Venezuela) and to attempt joint ventures abroad (notably in China), where Cuban firms are the foreign investors.14 Cuba has had some success with these strategies but has had great difficulty accessing promising markets in Europe, Latin America, and much of Asia. Yet it is the pharmaceutical multinationals that possess the requisite knowledge of national patent regimes and distribution networks that could take the Cuban biotech sector to another level of success. Also largely excluded are financial firms, reserving a monopoly over most financial transactions to state-owned banks. Capital markets are severely repressed in Cuba, a legacy of the Soviet planning model. Those international banks allowed to open representative offices in Cuba (Table 2) are generally restricted to international transactions that serve client needs.

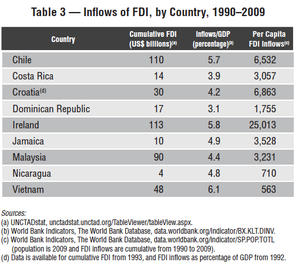

In countries roughly comparable to Cuba in size, or in those that share other similar characteristics, FDI flows have made substantial contributions over the last two decades. From 1990 to 2009, years in which Cuba was attracting roughly $3.5 billion in FDI, Costa Rica attracted $14 billion; the Dominican Republic, $17 billion; and Chile, $110 billion (Table 3). In Chile, the percentage of the population living in poverty had been cut in half during those two decades. With a population under 3 million and persistent political unrest and criminal violence, Jamaica attracted nearly $10 billion. Two pertinent Asian countries, Vietnam and Taiwan, attracted about $50 billion each. Socialist Vietnam retains a strong state presence in the economy and remains a one-party state. Taiwan, with a population of 23 million, is an island economy with a tense political relationship with its hegemonic neighbor. Ireland is also interesting, as it took advantage of its relatively well-educated workforce and access to European markets to attract over $110 billion in FDI. Also of interest to other developing countries seeking to attract high-tech FDI with proactive investment promotion policies is Malaysia, which attracted $90 billion, or $3,000 per capita (as compared to Cuba’s roughly $300 per capita).

In nearly all developing countries, most savings and investment are domestic in origin; still, FDI can make a significant contribution. During the two decades from 1990 to 2009, FDI as a percentage of GDP equaled about 6% in Chile, 4% in Costa Rica, 3% in the Dominican Republic, 6% in Ireland, 5% in Jamaica, 5% in Nicaragua, and 6% in Vietnam (Table 3, page 17). To its own detriment, Cuba has largely neglected an important source of badly needed capital. Let us imagine that Cuba had allowed FDI inflows equal to 5% of its GDP (the average for the countries on Table 3) during the decade from 2000 to 2009, or roughly $2.5 billion a year. In that scenario, Cuba would have absorbed some $25 billion—many times the existing joint-venture capital stock accumulated over two decades. The associated technology, management skills, and access to export markets could have transformed the business climate, catalyzed an atmosphere of dynamic change, and elevated Cuba toward a sustainable growth path.

Summarizing these findings, we can conclude that FDI added about $3.5 billion to Cuban savings and investment over the last two decades or so, contributed handsomely to exports of goods and services, and accounted for roughly 7% of domestic output. Joint ventures currently employ about 34,000 Cuban workers, or under 1% of the active labor force. The flows of FDI to Cuba compare unfavorably to the experience of other countries, whether for countries of similar size and location in the Caribbean Basin or in high-growth East Asia. In Cuba, the joint-venture sector is small in terms of numbers of productive firms and the number of Cuban workers they employ. Yet where foreign investors have been allowed to play a role—in key export sectors—joint ventures have contributed critically to Cuba’s economic survival. Once permitted to operate, joint ventures can be successful in the Cuban context. But the Cuban government has driven a wedge—whether by directly denying business permits to operate or by indirectly discouraging investors—between Cuba and the vast ocean of savings circulating the globe and driving capital formation, technological diffusion, economic growth, and poverty reduction in developed and developing countries alike.

1. Oficina Nacional de Estadisticas (ONE), República de Cuba, “Notas metodológicas,” Sector Externo, Anuario Estadístico de Cuba 2010, available at one.cu/aec2010/esp/08_tabla_cuadro.htm.

2. UNCTAD, World Investment Report (UNCTAD, 2010), Annex, tables 1, 2. (UNCTAD relies not on Cuban government data but on its own estimates for FDI flows. UNCTAD e-mail communication with author, June 15, 2012.)

3. World Development Indicators, the World Bank Database, data.worldbank

.org/data-catalog/world-development-indicators.

4. “Table 1-i: Inward Direct Investment Positions, as of End-2011. Reporting Economy: Spain,” International Monetary Fund, Coordinated Direct Investment Survey (IMF CDIS), available at elibrary-data.imf.org.

5. For details on Cuba’s key bilateral commercial relations, see Richard E. Feinberg, “Cuba’s Emerging Market Strategy,” sec. 2 in Reaching Out: Cuba’s New Economy and the International Response (Brookings Institution, 2011), 23–44; Anuario estadístico de Cuba 2002 and other issues; and Jorge F. Pérez- López, “The Rise and Fall of Foreign Investment in Cuba,” Cuban Affairs Journal 3, no. 1 (February 2008): 25.

6. Omar Everleny Pérez Villanueva, The External Sector of the Cuban Economy (Woodrow Wilson International Center for Scholars, 2010) and MINCEX, as cited in Omar Everleny Pérez Villanueva and Pavel Vidal Alejandro, “La inversión extranjera directa y la actualización del modelo económico cubano,” presentation, the Center for the Study of the Cuban Economy (CEEC), annual conference, June 20, 2012.

7. UNCTAD, Web Table 34, “Number of Parent Corporations and Foreign Affiliates, by Region and Economy, 2010,” available at http://goo.gl/F6Gt1.

8. CEEC, La inversion extranjera y de la Union Europea en Cuba (Havana: The European Union, 2012). See also Emily Morris, “Cuba’s New Relationship With Foreign Capital: Economic Policy-Making Since 1990,” Cuba in Transition 12 (2002): 158–78.

9. U.S.-Cuba Trade and Economic Council, “Foreign Investment Policy Change,” Economic Eye on Cuba, February 16–22, 1998, available at cubatrade.org/eyeonr.html#4; see also Economist Investment Unit, “Foreign Investment Focuses on Large Projects,” Cuba Country Briefing, February 12, 2001.

10. Mayra Espina Prieto and Viviana Togores González, “Structural Change and Routes of Social Mobility in Today’s Cuba: Patterns, Profiles, and Subjectivities,” in Cuban Economic and Social Development: Policy Reforms and Challenges in the 21st Century, ed. Jorge I. Dominguez et al. (Harvard University: David Rockefeller Center for Latin American Studies, 2012), 267, Table 8.2.

11. Omar Everleny Pérez Villanueva, The External Sector of the Cuban Economy (Woodrow Wilson International Center for Scholars, 2010), 4–5, available at wilsoncenter.org/cuba. See also Omar Everleny Pérez Villanueva, “Foreign Direct Investment in China, Vietnam, and Cuba: Pertinent Experiences for Cuba,” in Dominguez, Cuban Economic and Social Development, 193–226.

12. ONE, National Accounts, Table 5.2—Global Supply and Demand, available at one.cu/aec2010/esp/05_tabla_cuadro.htm.

13. Marc Frank, “Britain’s Havana Energy Sets Cuban Bioenergy Venture,” Reuters, November 12, 2012.

14. On joint ventures in China, see Julio A. Díaz Vázquez, China-Cuba: relaciones economicas 1960–2010 (Mexico, D.F.: Universidad Nacional Autonoma de Mexico, Cuadernos de Trabajo del CECHIMEX, 2011), 7, Table 2.

Richard Feinberg is a professor of international political economy at UC San Diego. His four decades of engagement with inter-American relations spans government service (in the Clinton administration, the State Department, and the U.S. Treasury), numerous Washington-based public policy institutes, the Peace Corps, and now academia. His first NACLA publication, critical of U.S. policy toward the Allende government, appeared in 1972. This article was adapted from a longer manuscript published by the Brookings Institute earlier this year.